Asian shares are set to climb in early buying and selling as markets parse Federal Reserve Chair Jerome Powell’s reminder that policymakers are in no hurry to ease rates of interest.

Article content material

(Bloomberg) — Asian shares are set to climb in early buying and selling as markets parse Federal Reserve Chair Jerome Powell’s reminder that policymakers are in no hurry to ease rates of interest.

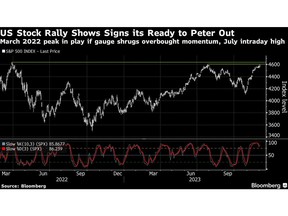

Fairness futures in Australia, Japan and Hong Kong level to early positive factors when markets reopen Monday. The S&P 500 index climbed increased Friday, to shut forward for a fifth week and attain its highest shut since March 2022. Contracts in mainland China level to an early loss after the Golden Dragon Index – a gauge of US-listed Chinese language shares – slumped 1% in its final session.

Commercial 2

Article content material

Article content material

US shares and bonds rallied Friday as Powell famous coverage is “nicely into restrictive territory,” although is able to hike additional if wanted. The greenback slid, two-year Treasuries yields sank to their lowest since June and merchants ratcheted bets on a quarter-point Fed minimize in March, with swaps absolutely pricing in a discount in Could. They mission over a full level of easing by December 2024.

“The large rebound in shares has left them technically overbought and vulnerable to a consolidation or brief time period pull again,” Shane Oliver, head of funding technique and chief economist at AMP Ltd. in Sydney wrote in a observe to shoppers. “Nonetheless, additional positive factors are probably into yr finish and early subsequent yr as inflation continues to ease” and constructive market seasonality kicks in later this month, he mentioned.

The latest rally in US shares and bonds comes as indicators are piling up — in latest knowledge, in warnings from prime retailers and in anecdotes from native companies throughout the nation — that after defying expectations all yr and splurging over the summer season, American households are beginning to pull again. A measure of US manufacturing facility exercise shrank for a thirteenth straight month in November as excessive rates of interest proceed to hammer the goods-producing facet of the financial system.

Article content material

Commercial 3

Article content material

Elsewhere Friday, oil prolonged declines, closing out a sixth straight weekly drop, because the OPEC+ output cuts introduced final week did not dispel the market’s gloom over swelling world provides. Copper rallied after the feedback by Powell and the looming shutdown of a giant mine in Panama emboldened bulls.

Learn Extra: Eerie Calm in S&P 500 Indicators Historic Rally Has Staying Energy

This week, merchants will probably be monitoring for clues to the well being of the worldwide financial system with Australian progress, Chinese language inflation and US non-farm payrolls knowledge all due. The Reserve Financial institution of Australia is anticipated to sound hawkish because it retains its price on maintain on Tuesday after governor Michele Bullock warned inflation is now homegrown.

Whereas the cooler-than-expected inflation will hold the RBA on maintain, “sticky ‘homegrown’ providers inflation will guarantee a tightening bias is retained,” Tony Sycamore, an analyst at IG Group in Sydney wrote in a observe to shoppers. “A price hike in February hinges on the end result of the December quarter inflation due for launch in late January.”

Merchants will probably be even be watching gold and oil markets as geopolitical tensions within the Center East and Asia present indicators of escalation. Israel has resumed its army operation in Gaza, a US warship was attacked within the Pink Sea and Houthi rebels in Yemen mentioned they’d carried out operations towards two Israeli ships.

Commercial 4

Article content material

In Asia, The Philippines’ coast guard on Sunday mentioned it monitored greater than 135 Chinese language “maritime militia” vessels “swarming” across the disputed Whitsun Reef within the South China Sea.

In company information, China Evergrande Group, the world’s most indebted developer, faces a Hong Kong courtroom listening to on Monday over a creditor request to wind up the corporate. US airline shares will probably be in focus when Wall Avenue reopens Monday after Alaska Air Group Inc agreed to purchase rival Hawaiian Holdings Inc.’s Hawaiian Airways in a deal valued at $1.9 billion.

Key occasions this week:

- China Evergrande Group liquidation listening to in Hong Kong begins, Monday

- Riskbank November assembly minutes launched, Monday

- RBA price resolution, Tuesday

- Japan’s Tokyo CPI, Tuesday

- China Caixin providers PMI, Tuesday

- South Korea CPI, GDP, Tuesday

- Eurozone PMIs, Tuesday

- Australia GDP knowledge, Wednesday

- Eurozone retail gross sales, Wednesday

- Financial institution of Canada price resolution, Wednesday

- China commerce, FX reserves, Thursday

- Eurozone GDP, Thursday

- Mexico CPI, Thursday

- Germany CPI, Friday

- Japan family spending, GDP, Friday

- US non-farm payrolls, Friday

Commercial 5

Article content material

A few of the foremost strikes in markets:

Shares

- S&P 500 rose 0.6% on Friday

- S&P/ASX 200 futures rose 0.9%

- Nikkei 225 futures rose 0.2%

- Dangle Seng futures rose 0.3%

Currencies

- The Bloomberg Greenback Spot Index fell 0.4%

- The euro was little modified at $1.0878

- The Japanese yen was little modified at 146.71 per greenback

- The offshore yuan was little modified at 7.1249 per greenback

- The Australian greenback fell 0.2% to $0.6664

Cryptocurrencies

- Bitcoin rose 0.3% to $39,687.15

- Ether rose 0.3% to $2,175.44

Commodities

- West Texas Intermediate crude fell 2.5% to $74.07 a barrel

- Spot gold rose 1.8% to $2,072.22 an oz.

This story was produced with the help of Bloomberg Automation.

—With help from Michael G. Wilson.

Article content material

Source link